In the dynamic world of startups and entrepreneurial ventures, the journey of MinusCal presents a cautionary tale of ambition, innovation, and the harsh realities of the business world. MinusCal, a company that once aspired to revolutionize the health and wellness industry with its fat blocker protein bars, has had a trajectory that offers valuable insights into the challenges faced by new businesses seeking to make a mark in competitive markets.

The Genesis of MinusCal

MinusCal was founded with a bold vision: to create a product that could help individuals manage their weight more effectively without having to give up on snacking. The company’s flagship product, a protein bar designed to block fat absorption and aid in weight loss, was grounded in a unique proposition. By incorporating a proprietary blend of ingredients, MinusCal aimed to stand out in the crowded market of dietary supplements and health snacks.

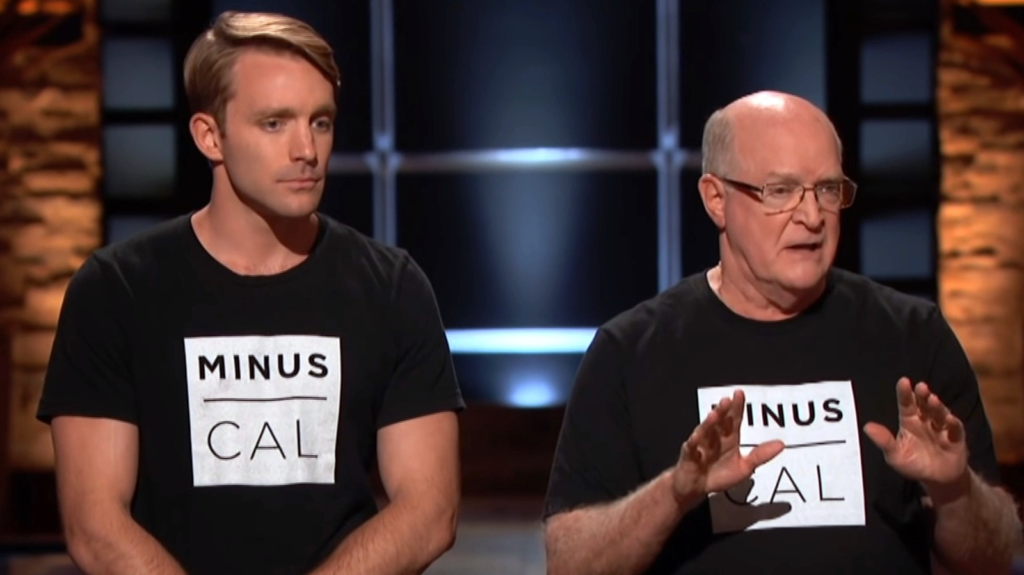

The Shark Tank Pitch

The public spotlight shone brightly on MinusCal when its founders took to the stage of “Shark Tank,” the popular television show that provides entrepreneurs an opportunity to pitch their business to a panel of potential investors. Seeking a $500,000 investment in exchange for a 20% stake in their company, the MinusCal team valued their business at $2.5 million. This ambitious valuation was predicated on the promise of their product and the potential market opportunity for healthier snacking options.

The Outcome and Challenges

Despite a well-articulated pitch and the founders’ enthusiasm, MinusCal did not secure an investment from the “Shark Tank” panel. The investors expressed concerns regarding the product’s market differentiation, the scientific basis of its claims, and the strategy for scaling the business. This outcome was a significant setback for MinusCal, highlighting the critical importance of solid scientific evidence and a clear value proposition in securing venture capital.

The Decline

In the aftermath of their “Shark Tank” appearance, MinusCal faced uphill battles on multiple fronts. The lack of investor confidence, coupled with the immense competition in the health and wellness sector, made it challenging for MinusCal to gain the traction needed for sustainable growth. Despite initial consumer interest and the founders’ efforts to market their product, the company struggled to achieve the sales volume required to maintain its operations.

Net Worth and Closure

As of 2024, MinusCal’s journey has come to an end. The company, unable to overcome the hurdles it faced, has ceased operations. With its closure, MinusCal net worth is effectively listed as $0. This stark figure reflects not just the financial valuation of the company but also the culmination of its efforts to bring an innovative product to market against formidable odds.

Lessons Learned

The story of MinusCal offers several key takeaways for entrepreneurs and startups. Firstly, it underscores the importance of robust scientific validation when making health-related claims about a product. Secondly, it highlights the necessity of a clear and compelling value proposition that differentiates a product in a saturated market. Lastly, it serves as a reminder of the critical role of investor confidence and strategic planning in securing the financial runway needed for growth.

Conclusion

While MinusCal’s ambition to contribute positively to the health and wellness industry was commendable, its journey underscores the multifaceted challenges faced by startups. In the end, MinusCal’s net worth may stand at $0, but the lessons learned from its story are invaluable for the next generation of entrepreneurs aiming to navigate the complex landscape of business innovation and market entry.